An Unbiased View of Not For Profit

Wiki Article

Get This Report about Irs Nonprofit Search

Table of ContentsIndicators on Google For Nonprofits You Need To KnowSome Known Details About Non Profit Organization Examples 501 C Can Be Fun For EveryoneAn Unbiased View of Non Profit Organization ExamplesNot For Profit Organisation Things To Know Before You BuyThe smart Trick of 501 C That Nobody is Discussing

While it is safe to state that most philanthropic organizations are honorable, companies can absolutely deal with several of the same corruption that exists in the for-profit business globe - not for profit. The Blog post discovered that, in between 2008 as well as 2012, more than 1,000 nonprofit companies inspected a box on their IRS Type 990, the tax obligation return form for exempt organizations, that they had actually experienced a "diversion" of possessions, suggesting embezzlement or various other fraudulence.4 million from purchases linked to a sham organization begun by a former aide vice president at the organization. An additional instance is Georgetown University, that experienced a considerable loss by an administrator that paid himself $390,000 in additional compensation from a secret financial institution account formerly unidentified to the university. According to federal government auditors, these tales are all also typical, and serve as sign of things to come for those that endeavor to develop as well as run a charitable company.

When it comes to the HMOs, while their "promotion of health for the advantage of the neighborhood" was deemed a philanthropic purpose, the court identified they did not operate primarily to profit the community by supplying health services "plus" something extra to profit the area. Hence, the revocation of their excluded status was upheld.

Rumored Buzz on Google For Nonprofits

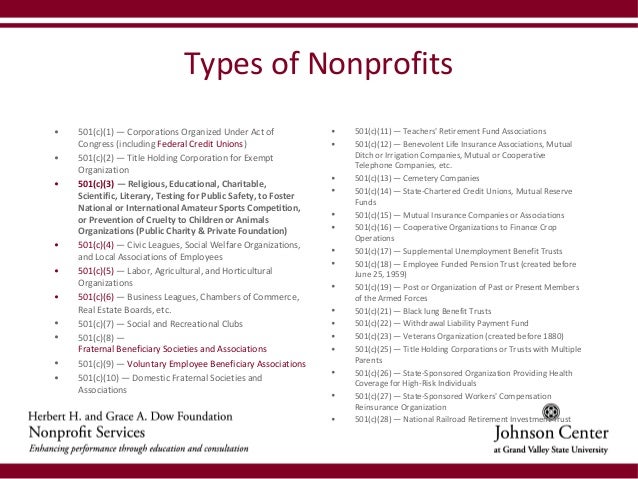

There was an "overriding federal government rate of interest" in prohibiting racial discrimination that exceeded the institution's right to complimentary exercise of religious beliefs in this way. 501(c)( 5) Organizations are labor unions as well as farming as well as gardening associations. Organized labor are companies that form when employees associate to involve in collective negotiating with a company concerning to incomes and also advantages.By contrast, 501(c)( 10) organizations do not offer payment of insurance advantages to its participants, therefore might organize with an insurance coverage firm to offer optional insurance policy without threatening its tax-exempt status.Credit unions as well as various other shared financial companies are classified under 501(c)( 14) of the internal revenue service code, and, as component of the financial sector, are greatly regulated.

6 Easy Facts About Nonprofits Near Me Shown

Getty Images/Halfpoint If you're thinking about starting a nonprofit company, you'll wish to understand the different browse around here kinds of not-for-profit classifications. Each classification has their very own needs and also conformities. Here are the kinds of not-for-profit classifications to aid you make a decision which is best for your organization. What is a not-for-profit? A nonprofit is an organization operating to enhance a social cause or support a common objective.Gives repayment or insurance coverage to their members upon sickness or other traumatic life occasions. Membership needs to be within the very same workplace or union.

g., online), also if the not-for-profit does not directly obtain Website contributions from that state. On top of that, the internal revenue service needs disclosure of all states in which a not-for-profit is signed up on Type 990 if the nonprofit has income of more than $25,000 per year. Fines for failing to sign up can include being forced to return donations or facing criminal charges.

The Definitive Guide to Non Profit Org

com can help you in signing up in those states in which you mean to obtain contributions. A not-for-profit company that gets substantial parts of its revenue either from governmental resources or from direct contributions from the basic public might certify as a publicly sustained company under section 509(a) of the Internal Revenue Code.

Due to the complexity of the laws and policies controling classification as an openly sustained company, include. Most individuals or teams create not-for-profit corporations in the state in which they will primarily run.

A not-for-profit company with business places in multiple states may form in a solitary state, after that sign up to do company in other states. This suggests that not-for-profit firms must officially sign up, submit yearly reports, as well as pay annual charges in every state in which they carry out organization. State laws call for all not-for-profit companies to preserve a registered address with the Assistant of State in each state where they work.

Not known Facts About Non Profit

Section 501(c)( 3) philanthropic organizations may not interfere in political projects or carry out significant lobbying tasks. Consult a lawyer for more specific information about your company. Some states just call for one supervisor, yet the majority of states need a minimum of 3 directors.

A company that serves some public function and also as a result enjoys unique treatment under the law. Not-for-profit firms, as opposed to their name, can earn a profit yet can't be designed mostly for profit-making. When it pertains to your business structure, have you thought of organizing your venture as a not-for-profit firm? Unlike a for-profit service, a not-for-profit might be eligible for specific advantages, such as sales, residential property and earnings tax obligation exemptions at the state level (google for nonprofits).

The smart Trick of 501c3 That Nobody is Discussing

With a not-for-profit, any money that's left after the organization has paid its bills is placed back into the organization. Some kinds of nonprofits can get contributions that are tax obligation deductible to the person that contributes to the company.Report this wiki page